By Shanker Man Singh

The government has appointed Santosh Narayan Shrestha as the Chairman of SEBON. After assuming the office, Shrestha said that SEBON's priority is a new stock license. Shrestha said, 'I have prepared well'. The government has appointed a person with experience in business and finance as the Chairman of the Securities and Exchange Board of Nepal (SEBON). The Chairman said that he will work on the pending issues of public issuance in SEBON, and that a lot of work needs to be done, but that much work has not been made public. However, even if it is not possible to do all the work after his appointment, it can be expected that work will be done in the interest of the country by prioritizing it.

In response to questions raised from time to time about the ability of the capital market regulator SEBON, criticism that it is unable to regulate, etc., the new chairman says that SEBON and the capital market are “well prepared” for reform.

Some dailies have also published news that the government has appointed the chairman of the capital market regulator Nepal Securities Board, ignoring the case pending in the Supreme Court.

In retrospect, the Maoist-UML coalition government seems to have collapsed as soon as the board chairman appointment process reached the court.

According to some people, the main challenge for the newly appointed Chairman in the coming days will be to prove himself as a “professional” on the board. Stock Exchanges in neighbouring countries. The presence of two major stock exchanges in neighbouring India, the Bombay Stock Exchange and the National Stock Exchange is a result of various historical, regulatory and structural factors.

Historically, the Bombay Stock Exchange is the oldest one in Asia and was established in 1875, while the National Stock Exchange was established in 1992. Both the Bombay Stock Exchange and the National Stock Exchange are private companies [sometimes people assume that they are government institutions like the Reserve Bank].

Both exchanges serve as a platform for investors to buy and sell securities. Stocks, bonds, and derivatives. The establishment of the NSE was the result of several structural and regulatory changes in the Indian financial markets.

The NSE was established as a technologically advanced and more transparent exchange with an electronic trading platform. It introduced a new level of efficiency, transparency and risk management capabilities that revolutionised the Indian capital markets.

Moreover, the competition between the two seems to have benefited the Indian capital market and investors by promoting innovation, improving trading processes, and reducing transaction costs.

It was heard in the past that there was a fierce battle between the business houses for the new stock exchange. The same battle even complicated the appointment of the SEBON Chairman, what is the truth? Time will tell.

Multiple Stock Exchange

Multiple stock exchanges may arise in a country for a variety of reasons, each serving different functions and markets. Here are some key points that explain their existence: Different exchanges may focus on specific sectors, types of companies, or investment strategies. For example, one exchange may cater to small-cap companies, while another focuses on larger, more established firms.

Geographical diversity- Countries with large geographic areas may have regional exchanges that allow local companies to raise capital and investors to trade securities close to home. This can contribute to local economic development.

Market segmentation- Exchanges may target different investor demographics. Some may cater to retail investors, while others focus on institutional investors, offering tailored services and products.

Competition- Multiple exchanges can foster competition, which can lead to better services, lower trading costs, and more innovative financial products for investors.

Regulatory framework- Different exchanges may operate under different regulatory frameworks, allowing them to offer different trading conditions and rules. This can attract different types of issuers and investors.

Access to capital- Having multiple exchanges can increase overall access to capital for companies, as they have more options to list and trade their shares. Technological Advancements- The rise of electronic trading platforms has made it easier to set up and operate multiple exchanges.

Liquidity: More exchanges can increase liquidity in the market, as investors have places to buy and sell securities, which can lead to tighter spreads and better pricing.

Overall, there is a consensus that the presence of multiple stock exchanges can contribute to a more dynamic and efficient financial market within a country.

What are stock exchanges?

Stock exchanges are organized markets where shares of ownership in companies are traded between buyers and sellers. These exchanges play a vital role in the global economy by providing businesses with capital and investors with a centralized place to buy and sell securities. While the concept dates back to 17th-century Amsterdam, modern stock exchanges have evolved into sophisticated, often digital, platforms for rapid, high-volume trading.

What is dual listing?

Dual listing refers to the listing of any security on two or more different exchanges. Companies use dual listings for their benefits, which include additional liquidity, increased access to capital, and the ability to trade for longer period of time if the exchanges where their shares are listed are in different time zones.

The country now has a "stable and strong government." "Interest rates in banks and financial institutions have come down significantly. But the market, which reached the 3,000 mark, could not be sustained. I want an answer to why this is happening," the Finance Minister had asked in the past.

It has been public for a long time that Nepal is preparing to distribute another stock exchange license. Even before the federal and provincial elections, there has been social media and financial communication about the distribution of new stock exchange licenses as a "cash cow".

While India, which has an economy of $2.623 trillion, has only two stock exchanges operating, the question of why Nepal, which has an economy of $31 billion, needs two was raised as the government was analyzing why it was issuing licenses. While there are demands to restructure the government-owned Nepal Stock Exchange (NEPSE) by selling its shares to the private sector, the question of why the government is opening another stock exchange without conducting a study remains unanswered.

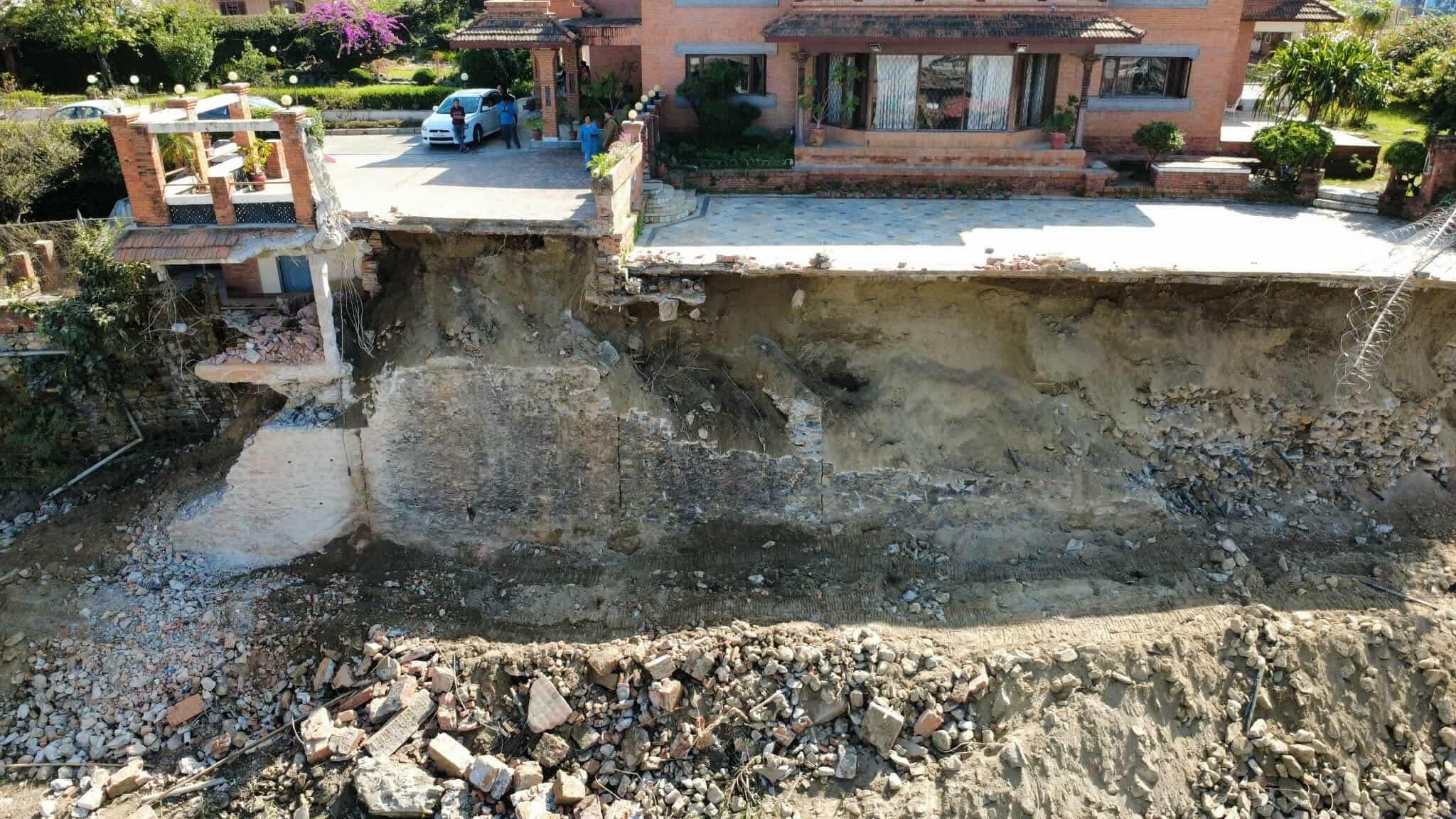

Although the government's five-year economic and financial strategy mentions the restructuring of NEPSE, now another exchange is being opened, putting its very existence in danger.

The Central Depository System and Clearing Limited (CDSC) is also in operation with the full investment of NEPSE. It has been performing both the tasks of recording the electronic account of shares and clearing the traded shares. If a new stock exchange comes into existence, a separate depository and clearing company is also required for the settlement of transactions and dematerialization of listed shares. Currently, the government is receiving more than one billion rupees in annual dividends from NEPSE. The private sector has demanded permission from the Securities and Exchange Board of Nepal to operate a new stock exchange.

The current stock exchange has been adversely affected by the inability to provide infrastructure as per the needs of the market and conduct transactions in a hassle-free, easy, simple and diverse manner, which is affecting the development of the entire stock market.

Therefore, the private sector has demanded permission to operate another stock exchange that will have widespread participation and operate in accordance with international good governance standards. Investing in the stock market is not just like depositing money in a bank.

Those who invest in the capital market should first understand this well. New investors should always start from the primary market and invest from a small amount. If you jump in without understanding, there is a strong possibility of drowning later.

Increasing competition, benefiting investors, increasing the capacity of regulatory bodies, developing the market, providing tax breaks based on the situation, and increasing permanent policies are the needs of the day.

The private sector has demanded permission from the Securities and Exchange Board of Nepal to operate a new stock exchange. Since the current stock exchange has not been able to provide infrastructure as per the needs of the market even during its long period of operation and has not been able to make the trading system trouble-free, easy, simple, and diverse types of securities transactions, the development of the entire stock market is being adversely affected.

Therefore, the private sector has demanded permission to operate another stock exchange that will have widespread participation and operate in accordance with international good governance standards. Investing in the stock market is not just like depositing money in a bank. Those who invest in the capital market should first understand this well. New investors should always start from the primary market and invest from a small amount.

The recent meeting of the Council of Ministers has approved and sent all three regulations related to the capital market, namely the Securities Market Operation Regulations, 2074 BS, the Securities Businessmen (Securities Brokers and Securities Dealers) 2064 BS, the Fourth Amendment, and the Securities Registration and Issuance Rules, 2073 BS.

However, the plan to reform NEPSE and bring in the private sector by disinvesting government investment was also discussed from time to time. Overall, we have to see how it goes in the coming days.

Comments:

Leave a Reply